Calls and puts calculator

Ad Trade with the Options Platform Awarded for 7 Consecutive Years. This means that the OTM calls and hence ITM puts are trading with higher volatilities than normal against their at-the-money.

/dotdash_Final_Understanding_How_Options_Are_Priced_Aug_2020-01-c5699fc51f48461fa3413e4e97049857.jpg)

Option Pricing Models Formula Calculation

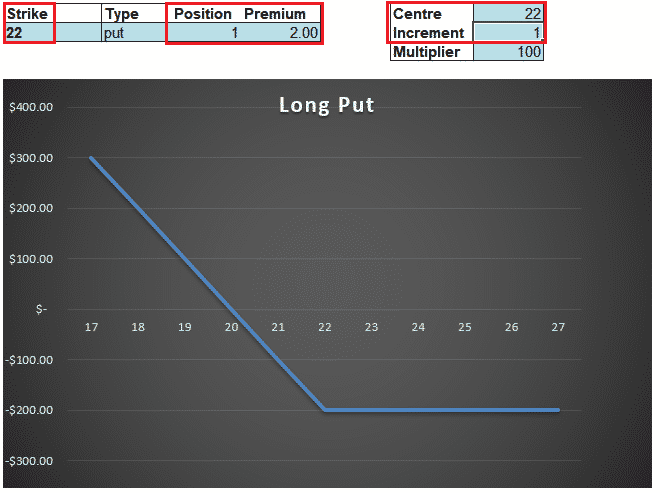

The long put calculator will show you whether or not your options are at the money in the money or out.

. When purchasing a call option you are buying the right to purchase. Open an Account Now. Find a Dedicated Financial Advisor Now.

The price of an option is a function of many variables such as time to maturity underlying volatility spot price of underlying asset strike price and interest rate it is critical for the option. Select your option strategy type Short Call or Short Put Step 2. Ad Discover a Path to Financial Security.

He will sell put options is 15 and also short sell the stock Short Sell The Stock Short. CallPut Spread Profit Calculator A call spread strategy consists in buying and selling a same quantity of calls but with a different strike price. Discover Which Investments Align with Your Financial Goals.

The gain or loss is calculated at expiration. Smartly designed order window and order. This tool can be used by traders while trading index options Nifty options or stock.

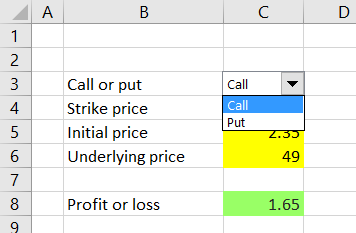

Options Type - Select call to use it as a call option calculator or put to use it as a put option calculator. See how this trading course helps small investors earns Extra Income. My 54K Account Into 174000 - In Less Than 9 Months.

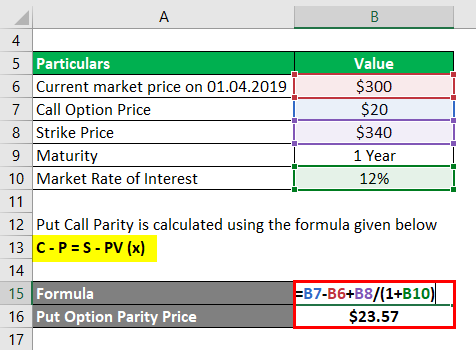

My 54K Account Into 174000 - In Less Than 9 Months. Excel Profit Calculator. In the put-call calculator by entering the information for the put option underlying asset and strike price you can easily calculate what the put option should be based on the put.

With the SAMCO Option Fair Value Calculator calculate the fair value of call options and put options. Invest in Direct Mutual Funds New Fund. Ad Discover a Path to Financial Security.

The bonus is you. Poor Mans Covered Call calculator addedPMCC Calculator. This app calculates the gain or loss from buying a call stock option.

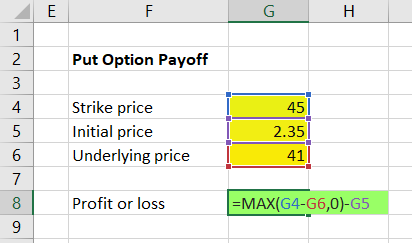

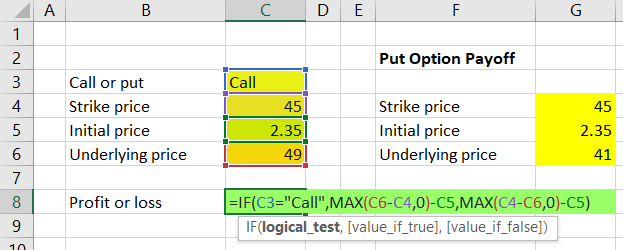

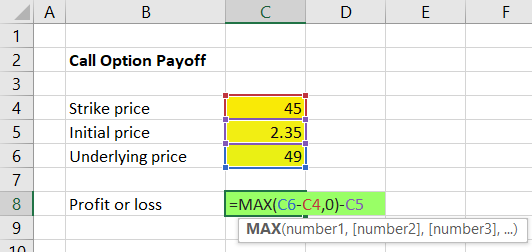

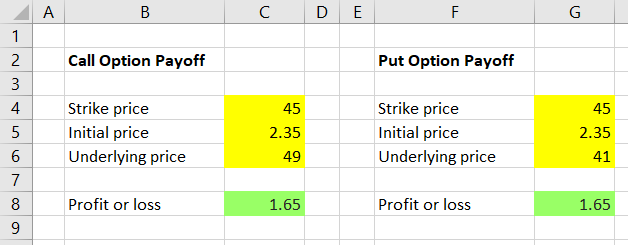

Discover Which Investments Align with Your Financial Goals. The put option profit or loss formula in cell G8 is. Call Option Calculator Call Option Calculator is used to calculating the total profit or loss for your call options.

Enter the underlying asset price and risk free rate. MIS gives you the auto square-off facility for open positions before market closes. Ad Discover how my Weekly Paycheck Method tripled account in 8 mo.

Put Option Calculator is used to calculating the total profit or loss for your put options. Enter the maturity in days of the strategy ie. Cash Secured Put calculator addedCSP Calculator.

Get your Free Copy here. Gain access to the Nasdaq-100 Index at 1100th the notional value. You can use this Black-Scholes Calculator to determine the fair market value price of a European put or call option based on the Black-Scholes pricing model.

Ad Heres how ordinary people are earning 5000 - 20000 each month in their spare time. As a result both downside and upside are. The Profit at expiry is the value less the premium initially paid for the option.

An option is a derivative a contract that gives the buyer the right but not the obligation to buy or sell the underlying asset by a certain date expiration date at a specified. This is part 2 of the Option Payoff Excel Tutorial where we are building a calculator that will compute option strategy profit or loss and draw payoff diagramsIn the first part we have. He will buy a call by investing 29 and will invest 31818 a risk-free interest rate of 10 for a year.

Where cells G4 G5 G6 are strike price initial price and underlying price respectively. An call options Value at expiry is the amount the underlying stock price exceeds the strike price. Get your Free Copy here.

Ad Trade with the Options Platform Awarded for 7 Consecutive Years. Stock Symbol - The stock symbol that you purchased your options contract with. The result with the inputs shown.

Find the best spreads and short options Our Option Finder tool. Ad Discover how my Weekly Paycheck Method tripled account in 8 mo. Ad Sign up for the latest on how to invest in Nasdaq-100 Index Options.

Open an Account Now. Find a Dedicated Financial Advisor Now. It also calculates and.

These calculations are all quite straight forward but if you want to visualize this in excel you can download the handy calculator below. Get the most from your trading by just paying a small margin. The long call calculator will show you whether or not your options are at the.

Calculating Call And Put Option Payoff In Excel Macroption

Probability Of A Successful Option Trade

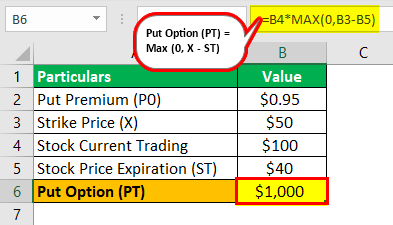

Put Options Definition Types Steps To Calculate Payoff With Examples

Call Option Calculator Put Option

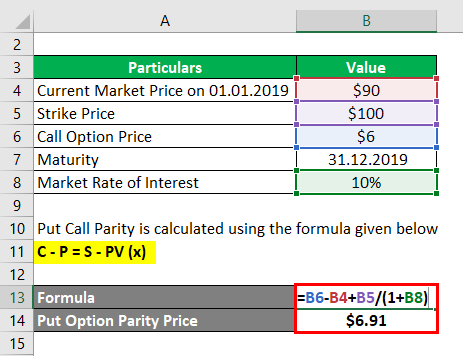

Put Call Parity Formula How To Calculate Put Call Parity

Option Premium Calculator Streamlined And Easy To Use

Calculating Call And Put Option Payoff In Excel Macroption

Put Call Parity Formula How To Calculate Put Call Parity

Put Call Parity Formula How To Calculate Put Call Parity

Put Option Calculator Easy To Use Excel Tool

/dotdash_Final_Understanding_How_Options_Are_Priced_Aug_2020-01-c5699fc51f48461fa3413e4e97049857.jpg)

Option Pricing Models Formula Calculation

How To Calculate The Profit On A Call Option Quora

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_How_Options_Are_Priced_Aug_2020-02-ba51015e895b4ba7abbd7632e1908360.jpg)

Option Pricing Models Formula Calculation

Merging Call And Put Payoff Calculations Macroption

Calculating Call And Put Option Payoff In Excel Macroption

Using The Free Trade Calculator To Profit On Call And Put Spreads Option Party

Merging Call And Put Payoff Calculations Macroption